인기 검색 계정

Angelo Castillo(@profitplugg) 인스타그램 상세 프로필 분석: 팔로워 810,655, 참여율 5.08%

@profitplugg

인증됨Angelo Castillo

I help "20 somethings" start building their wealth! 📩 angelo@profitplug.co US Bank👇🏽

https://www.usbank.com/credit-cards/bank-smartly-visa-signature-credit-card.html?ecid=SM_701788@profitplugg님과 연관된 프로필

연관 프로필이 없습니다

이 계정에 대한 연관 프로필 정보를 찾을 수 없습니다

@profitplugg 계정 통계 차트

게시물 타입 분포

시간대별 활동 분석 (최근 게시물 기준)

@profitplugg 최근 게시물 상세 분석

동영상 게시물 분석

여러 장 게시물 분석

@profitplugg 최근 게시물

5 Things To Do in Your 20s To Not Go Broke in My 30s 1. Focus on Learning, rather than earning. Your paycheck will follow your skillset. increase your earning potential now when you have the time and energy rather than later 2. Read “the defining decade” + “5 types of wealth” @sahilbloom @drmegjay Two of my favorite books. Great to read if you feel directionless and need that spark! 3. Audit your habits Your life doesn’t change in big moves. it’s the consistent daily actions that decide your life trajectory. Choose to be better. 4. Save/invest atleast 20% of your income get in the habit of saving and investing atleast 20% of your income. if you can’t right now, work towards it. 5. Choose your circle wisely You become the average of the 5 people you spend the most time with. Your circle can either bring you up or drag you down. You don’t need to cut people off if they aren’t “mega rich” or doing XYZ, but if they drain your energy and are generally bad for you, then yeah cut them off. What would you do differently? Comment down below what you think! #selfimprovement #money #wealth #savemoney #invest #makemoney #wealth #wealthy #personalfinance

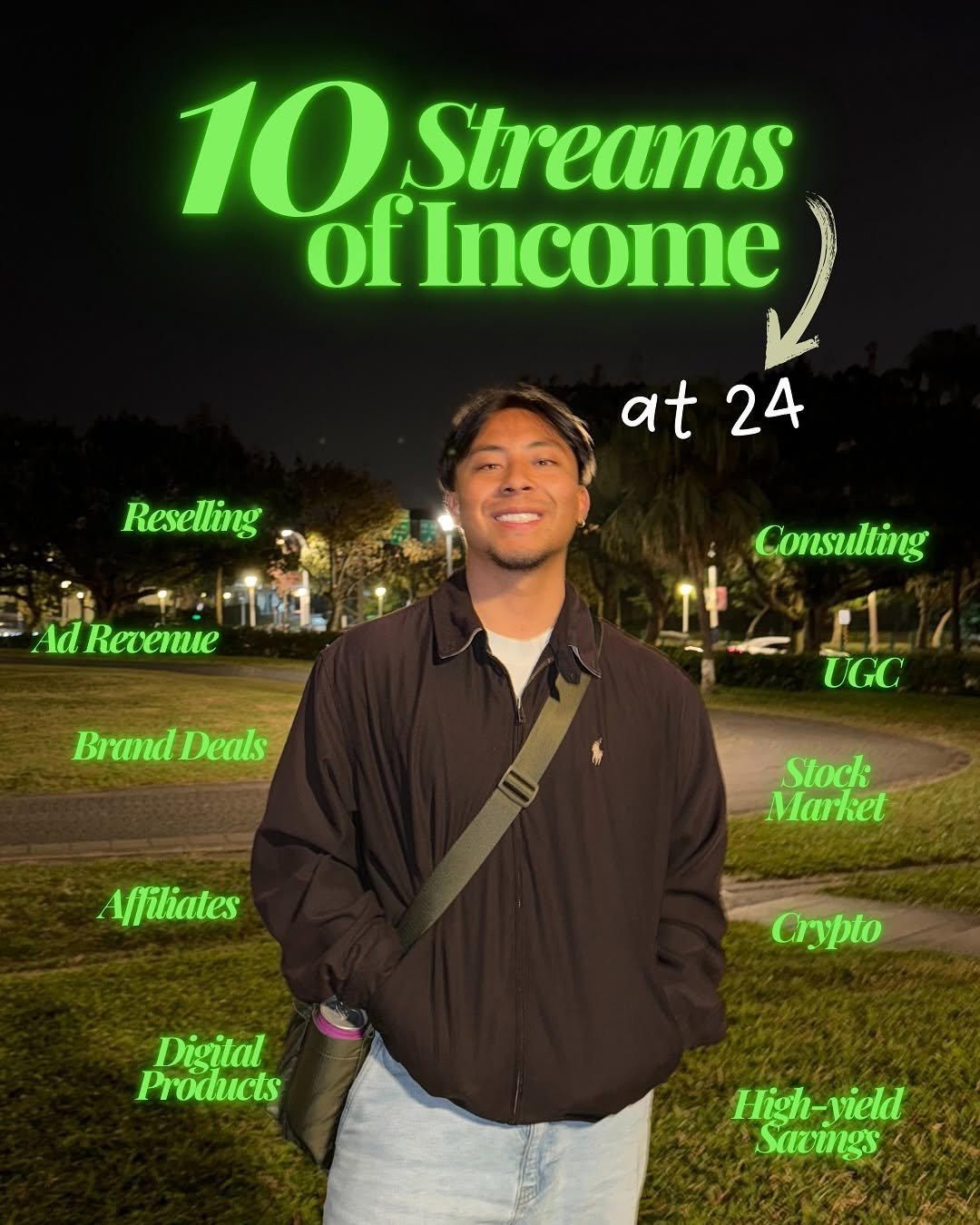

My 10 Streams Of Income At Age 24 💰 Comment “YT” for a the full breakdown! Mind you guys, this took me YEARS to build. Nothing came quick and nothing was easy. Also not all streams of income are made equally. Some only make me a couple hundred dollars, some a couple thousand. Most of these are all complimentary to each other, I did not go start 10 different businesses. Still got along way to go, and a lot to learn 🫡 Lmk if you have any questions! #income #money #personalfinance #invest #millionaire #wealth #rich #wealthy #wealthmindset #richmindset #hustle #business

How To Invest Your First $1,000 (ft my sister) 💰 (comment “BlOSSOM” to see my entire investment portfolio for free!!🫡) The earlier you invest, the faster you will build your wealth. By helping my sister start investing this early, I am not only setting up her future but securing it. By the time she is 18, she will know how to multiple her money, have that growth/long term mindset, but also have experience with the stock market. If you haven’t invested yet, use this as a blueprint. It’s only scary before you actually do it! Invest, Invest, Invest!!!! Also palentir was a joke. #investing #invest #stockmarket #stocks #personalfinance #money #wealth #wealthmindset #rich #millionaire

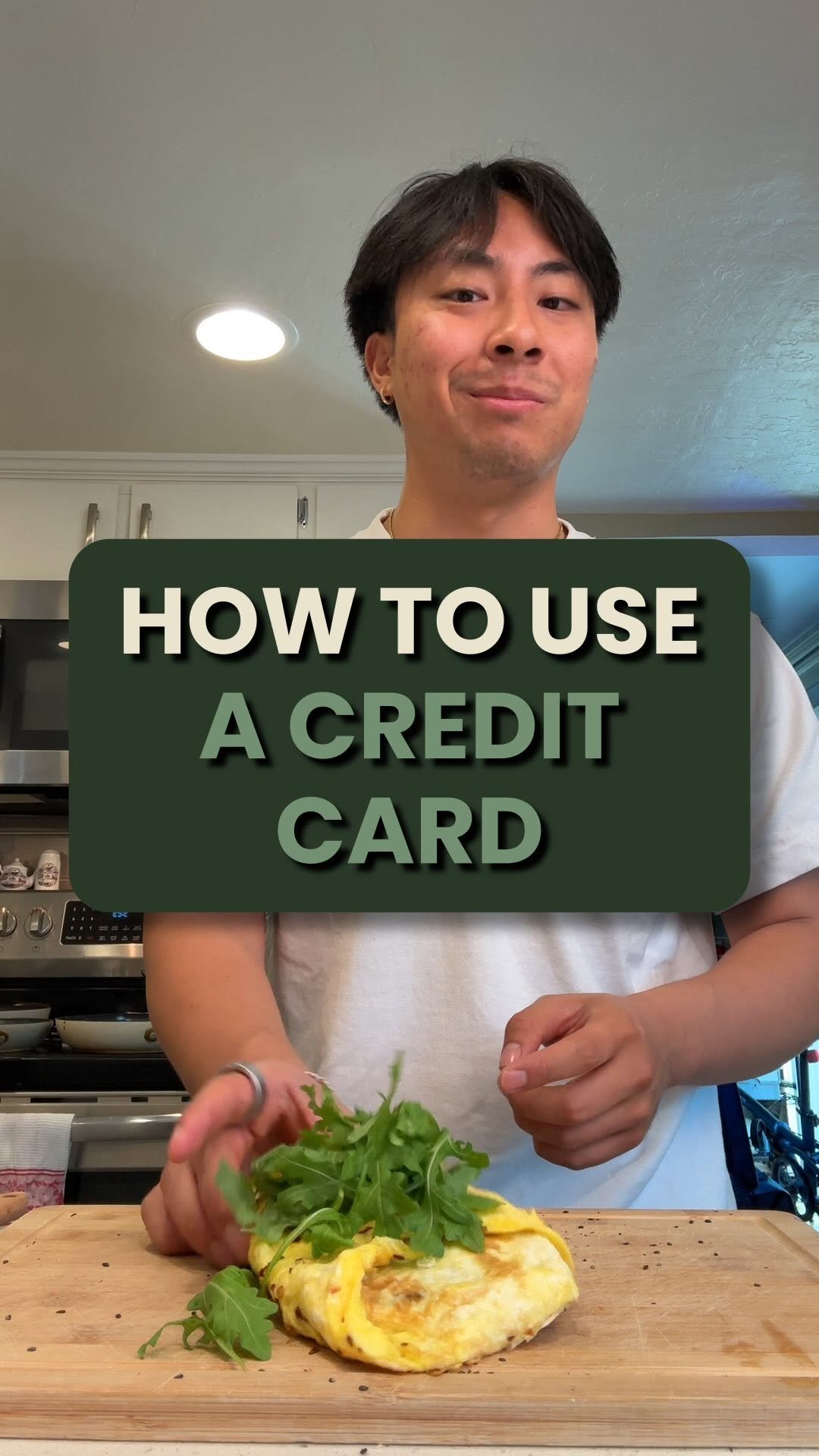

3 Ways To Use A Credit Card In Your 20’s 💳 Using credit cards the WRONG way is a one way ticket towards financial doom. So that is why there are 3 rules I live by when it comes to credit cards. 1. Always try to pay more than the minimum balance. Paying in full is optimal and most importantly, pay on time. 2. Use it! If you can be responsible, credit cards are great for getting cash back or travel points. So 95% of the time, im using a credit card 3. Choose wisely. Not every card is for you, and you aren’t meant for every card. That is why I’m pretty picky. One of my favorites that I recently found is the U.S. Bank Smartly™ Visa Signature® Card. Unlimited 2% cash back on every purchase! Doesn’t get too much better than that. If you want to check it out, I’ll leave a link in my bio! #ad #sponsored #USBankPartner #EarnMoreSmartly

What To Do If You Win The Lottery 🏦 #money #wealth #personalfinance #jackpot #powerball

3 ETFs I’d Start With Just $1,000 💰📈 Comment “5STEPS” for my free beginner investing guide! #investing #etf #stockmarket #firemovement #moneytips #personalfinance #wealthbuilding

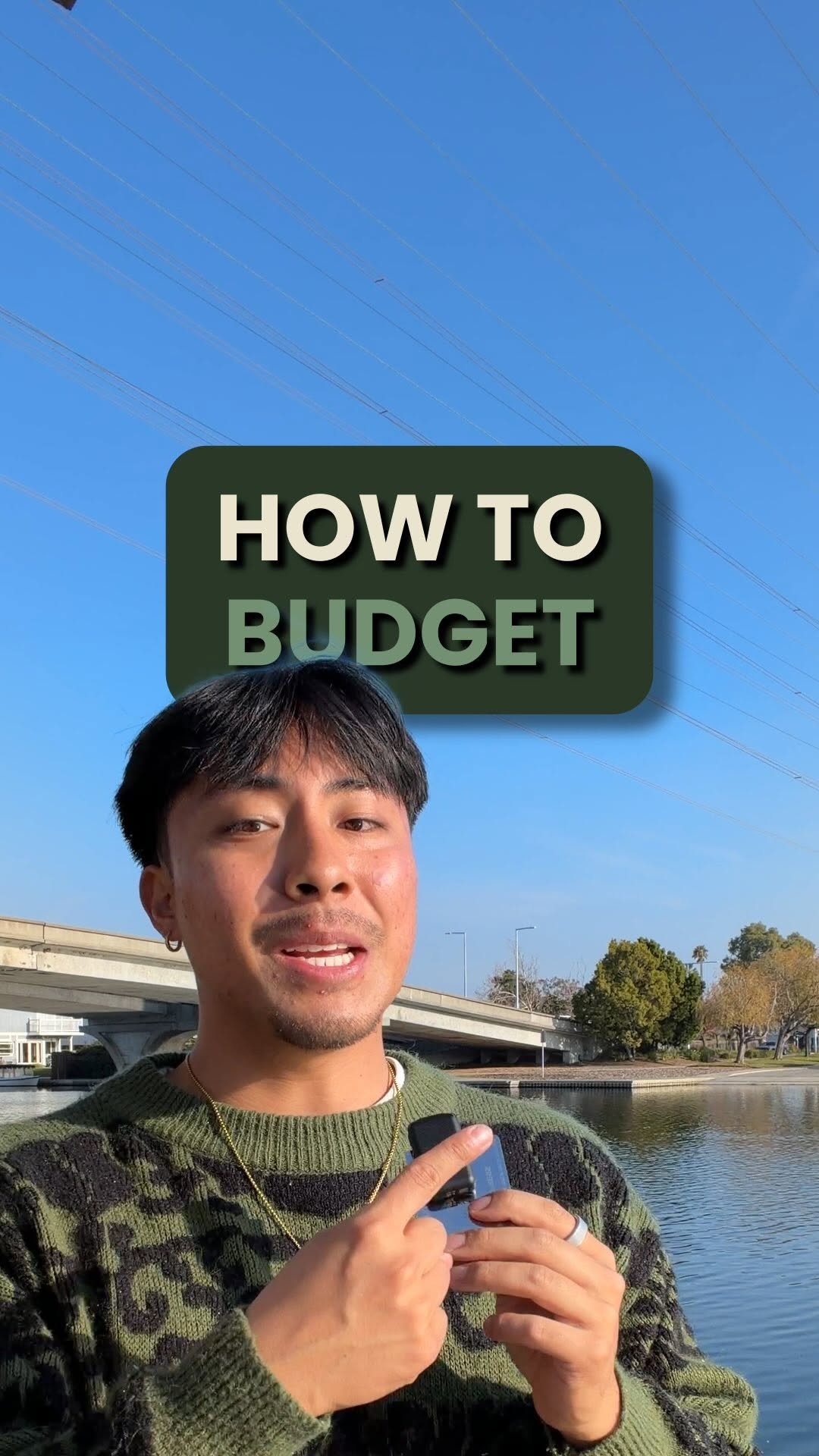

How to Budget in Your 20s 💰 How you spend your money, shows what you value in your life. Creating a budget is a way to get your priorities in check and see what you really value. Here’s how to do it 1. Run the numbers: track all your expenses and income for the next 30 days (90 days is better) and see how much comes in and goes out. See how much of your income is left over. 2. Set the rules: Now you know where the money is going, this is where you need to decide what you value. Do you want ot spend more on your entertainment, health, rent or luxories etc. it’s up to you to set up these parameters. most important part is the savings. 3. Optimize: This is where you cut the fluff and reallocate the money to things that actually matter to you. This isn’t easy to do, but it’s the first step in mastering your money. #money #budget #finance #wealth #personalfinance

How To Invest Your First $1,000 📈 Investing is one of the most important things you can do in your 20’s if you don’t want to be broke. Comment “5TEPS” for the free beginner guide to investing! Step 1: Get a brokerage This is just the hub/app where you are going to buy and hold your stocks. Don’t over think it too much, you can always change later on. I like vanguard, webull and fidelity. Step 2: Invest your money After you sign up, transfer some money and buy stocks. Alot of people mess this up so make sure you actually invest! This depends on to you and your goals, but I would keep everything really super simple and just invest into index funds for the first 6 figures. Keep it simple stupid! (not financial advice) Step 3: Automate your investments By far the most important part, automate your investments!!! Investing is a long term game, it only works if you are consistent. Set this up once and you can always change the amount later on! #money #personalfinance #investing #wealth #stockmarket

What To Look Out For When Vehicle Shopping 🛻 The price you see is never what you actually end up paying. That’s why I teamed up with @fordelectric to show the difference and why going electric could be the smart move. #ad 1. You save on filling up Depending on where you live, gas can be reallyyy expensive (I’m in California). Charging can be up to half the cost of gas, especially if you charge at home or have solar! 2. Less scheduled maintenance costs Gas trucks have more moving parts to maintain than electric trucks, meaning you can save on routine upkeep like oil changes, smog checks, fluid flushes, and more. In fact, F-150® Lightning® truck owners save about 48% on scheduled maintenance compared to a gas F-150® over 5 years. 3. Awesome ride and great features! After driving the Ford F-150 Lightning, I can noticeably feel the quality, safety, and smoothness of this electric truck. I’ve never been a car guy, but I understand it now 🤣 If you want to check out how much you can save by going electric, check out the Ford website. Power Promise in the link in bio 👈 Savings results may vary. 2025 Ford F-150® Lightning® Platinum model with optional equipment shown #ford #f150lightning #ev #moneymoves totalcostofownership savemoney personalfinance genz budgeting wealthmindset money frugal investing growthmindset wealthy wealth

5 Things I did To Become A Millionaire in My 20s (caption ⬇️) 1. Save 50% of my income It’s never about how much you make, it’s about how much you keep. Most people spend every dollar they get or build a lifestyle that forces them to. Saving half made me ruthlessly honest about what I actually valued versus what I was just spending on autopilot. 2. Invest as much as possible You can’t get rich just saving—your money needs to make you more money. We all have 24 hours, but investing means your money is working even when you’re not. 3. Increase income The best use of my time was building skills and reinvesting in my business. I wouldn’t be here if I’d only focused on cutting costs instead of growing my income ceiling. 4. Avoided the wealth killers New car payments, lifestyle inflation, gambling, designer stuff, credit card debt. These aren’t just expenses—they actively work against you while investments work for you. 5. Keep learning If you want exceptional results, you need to become exceptional. That means making self-development non-negotiable, not something you do “when you have time.” So after college i never stopped learning. I enrolled in mentorships, courses, bought books, attended event, pretty much everything i could to learn more. These may seem very cliche, but it’s a very realistic but broad plan that I followed in order to build my wealth. This is the “what” part, which is easier part. The “how” is where you have to really go into the nitty gritty and lock in. If you want a part 2 on the “how” lmk in the comments below! #money #personalfinance #investing #mindset #wealth

My $170K Investing Strategy and Portfolio 📈 Comment “BLOSSOM” to see what I’m investing in + my full portfolio We didn’t quite reach the goal of hitting $200K in 2025. but here’s what I plan to do to hit $300K this year. Disclaimer: This is my high-risk-high-reward portfolio where I actively trade. If you’re a beginner I do not reccomend starting with individual stocks. It’s a lot more stressful and time consuming index funds and etfs are the wave. Investing changed my life, and it can change yours to, so please start as early as you can! #money #personalfinance #investing #mindset

My Automated Payday Routine 🏦 COMMENT “HYSA” for the link + bonus! Money sitting is money losing. That is why a majority of my money/savings is in a high yield savings account. One of the HYSA’s I love and use is @chime They have one of the most competitive interest rates plus a bonus of up to $350! Sign up today, future you will thank you! #ChimePartner #money #personalfinance #banking #wealth $350 Intro Offer: *Terms apply. Limited time only, must open the new account and complete qualifying activities to earn 3 individual rewards, up to a max of $350.00, as described at https://www.chime.com/policies/newmemberofferv3. 3.50% Chime+ APY is only available to members who maintain eligibility for Chime+ status, otherwise the 1.00% APY will apply. APY means Annual Percentage Yield. No minimum balance required. See Chime.com for details. Chime Checking Account is required to be eligible for a Savings Account.